maryland ev tax credit 2022

From next year 40 per cent of the minerals used in the batteries of its EVs need to be manufactured or assembled in. As automakers call on the US government to rethink a plan to limit tax credits for electric vehicles theyre facing opposition from an.

What You Should Know About The Electric Vehicle Tax Credit Updates 2022 Mycpe

Interestingly the used car tax credit on EVs is also limited to.

. Maryland offers a rebate of 40 of the cost. Tesla and General Motors GM reached their caps years ago. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid.

Used EVs must be at least two years old and the. Section 25E of the Inflation Reduction Act text also says that a car must be at least 2 model years older than the year in which you bought it. Learn more about the incentives and rebates on EVs and Home Charging Stations in Maryland below.

Effective July 1 2023 through June. Used EVs would now be eligible for a 4000 federal tax credit wit a price cap of 25000. Funding is currently depleted for this fiscal year.

For additional information contact the Maryland Environmental Trust at 410-514-7900 the Maryland. Would apply to new vehicles purchased on or after July 1 2017 but before July 1 2023. 4th 2022 734 am PT.

As noted above the EV tax credit is a graduated figure conditioned on battery capacity. The Homeowners Property Tax Credit Program provides tax relief for eligible homeowners by setting a limit on the amount of property taxes owed based on their income. New Federal Tax Credits under the Inflation Reduction Act.

EV tax credits rebates incentives and exemptions by state. 3000 tax credit for. If the stimulus bill get passed with the solar tax credit extension then you will get 26 if installed by 2022.

Tax credits are calculated as 30 percent of the total installed cost of the energy storage system up to 5000 for residential systems and 150000 for commercial systems. On January 1st used EVs priced 25000 or less will be eligible for a 4000 tax credit or 30 of the sales price whichever is lower. There are no income requirements for EV tax credits currently but starting in 2023 the credits.

Maryland offers a tax credit up to 3000 for qualified electric vehicles. The ev tax credit will. Marylands Theatrical Production Tax Credit provides a refundable credit of 25 percent against state income tax to eligible for-profit live stage theatrical productions for costs.

Funding is currently depleted for this Fiscal Year. Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit. Newer EVs like the Ford Mustang Mach E and Rivian R1T were both eligible for the full tax incentive of 7500.

South Korean officials and leaders from Japan are expressing concerns over the new US EV tax credit requirements that kick in at the end of the year. Toyota recently reached its cap in June 2022 and started phasing out its tax credits. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle.

Used EVs will get a tax credit. Once it is eligible for the full tax credit GMs work wont end. Those with the least voltage can still count for a minimum EV rebate in 2022 of.

Between july 1 2021 and june 30 2022 the rebate may cover 40 of the costs of acquiring. Up to 26 million allocated for each fiscal year 2021 2022. If youre wealthy and you want to use the EV tax credit 2022 is the time to buy.

The eventual amount received by electric vehicle customers was based on the size of an EV. If you itemize deductions see Instruction 14 in the Maryland resident tax booklet. Before this date it remains a tax credit.

Timeline to qualify is extended a decade from January 2023 to. The full ev tax credit will be available to individuals reporting adjusted. Maryland student loan tax credit deadline.

Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids. Federal tax credit for EVs will remain at 7500.

Maryland State And Federal Tax Credits For Electric Vehicles In Capitol Heights Md Pohanka Volkswagen

Hoyer Visits Bowie To Highlight House Democrats Agenda The Future Of Electric Vehicles The Baynet

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Hyundai Of Capitol Heights

Ev Tax Credit 2022 Updates Shared Economy Tax

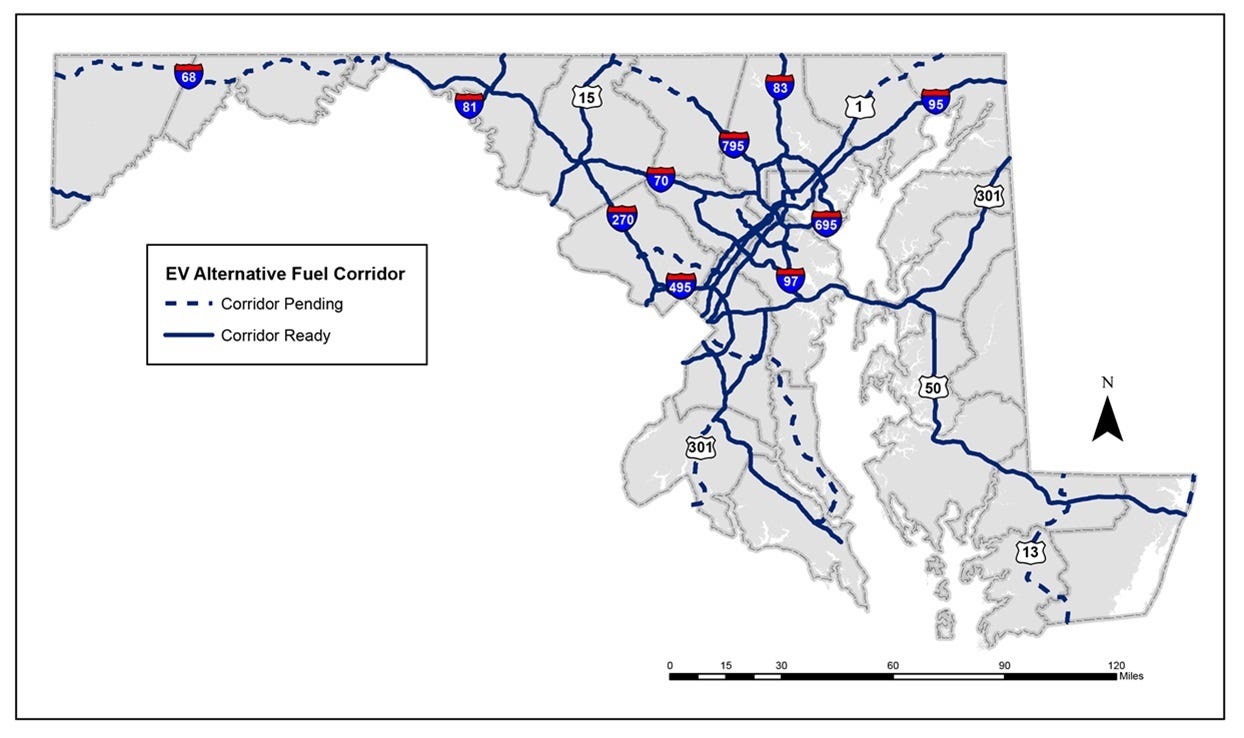

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Electric Vehicles Doubled In Maryland In Two Years

Maryland Solar Incentives Md Solar Tax Credit Sunrun

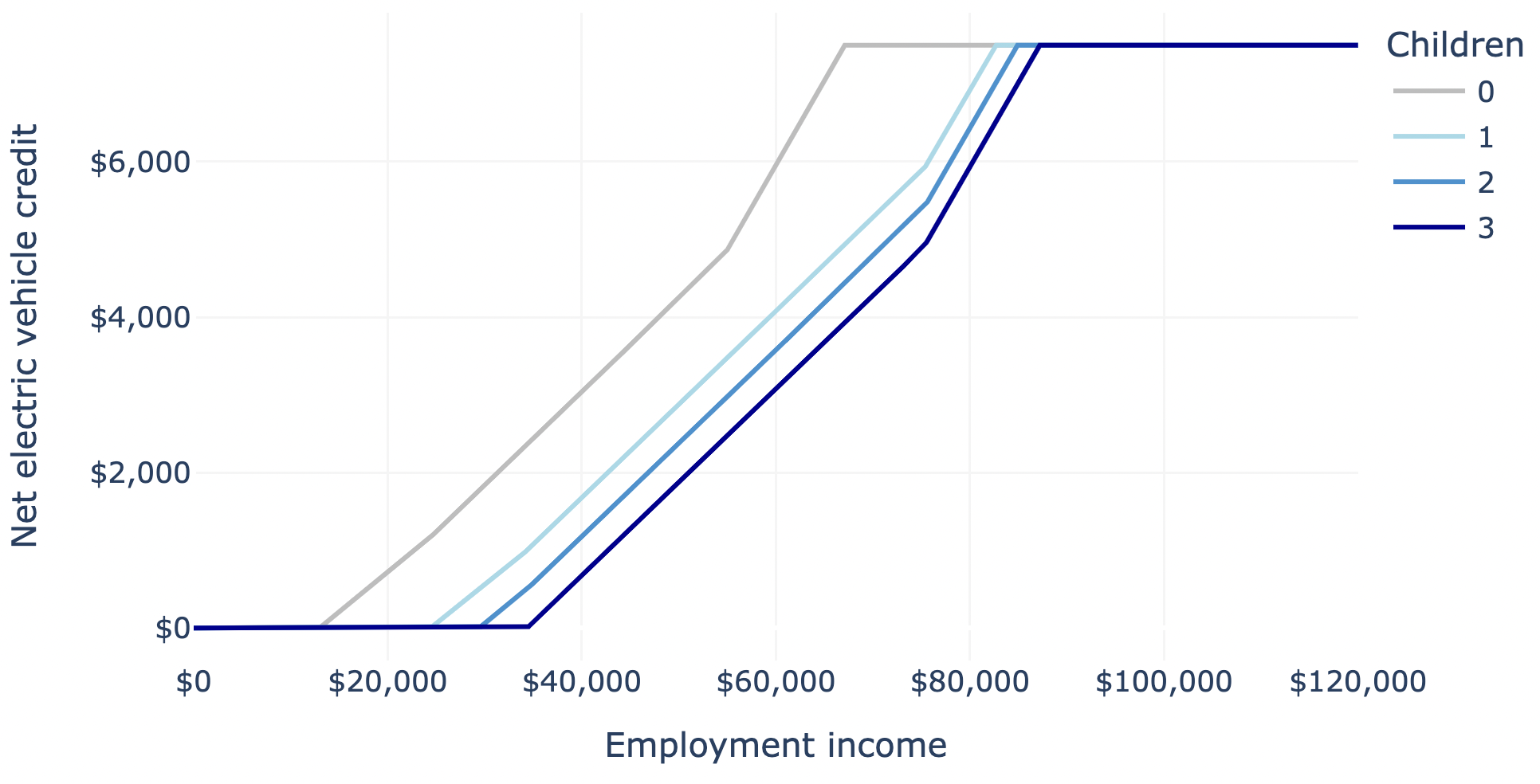

The Inflation Reduction Act Discourages Electric Vehicle Buyers From Working

Electric Vehicles Pepco An Exelon Company

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Hyundai Of Capitol Heights

The Inflation Reduction Act Discourages Electric Vehicle Buyers From Working

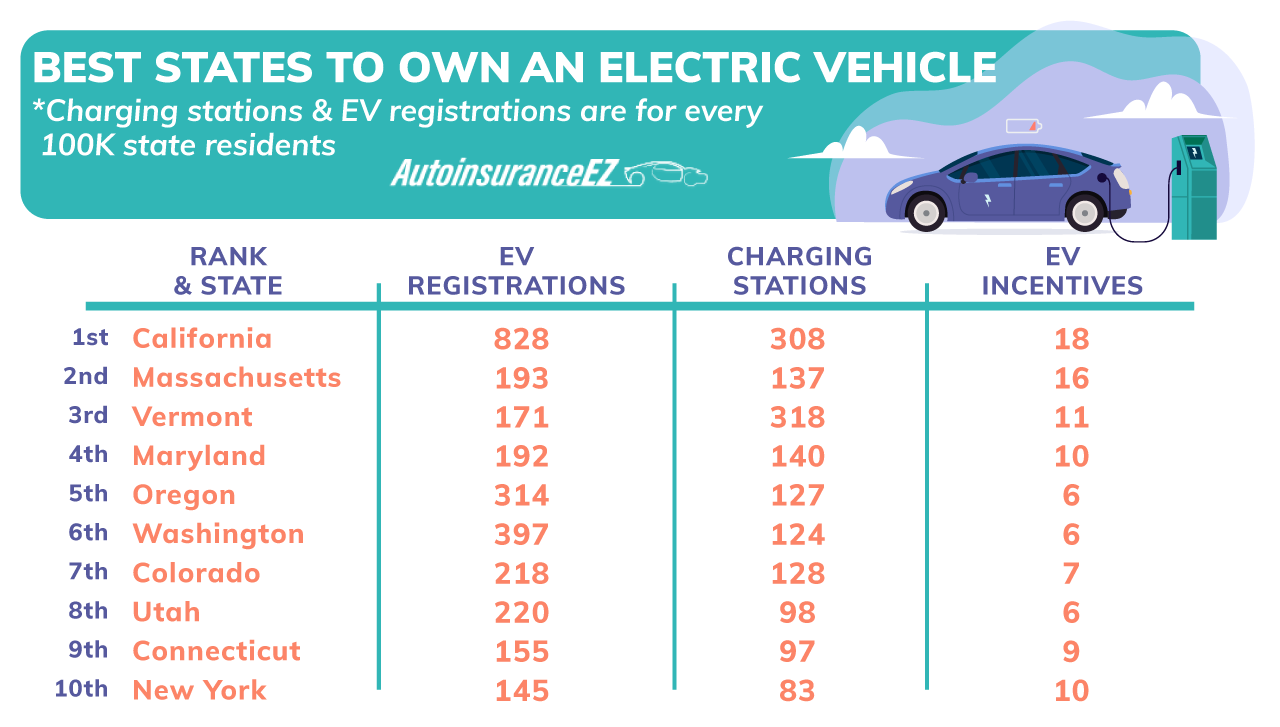

10 Best States To Own An Electric Vehicle 2022 Study Autoinsuranceez Com

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek

Electric Car Tax Credits What S Available Energysage

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Why The New Federal Tax Credit Rules May Just Kill The Ev Incentive For Good

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive